What are FICO Scores?

If you’ve ever applied for any type of credit ranging from credit cards to mortgages or auto loans you have probably heard the term FICO score.

That’s because there’s a 90% chance that your lender used the FICO credit scoring model to determine your creditworthiness and ability to repay the debt.

In short, a FICO score is the preferred credit scoring model for the majority of the lending industry.

According to a recent CEB TowerGroup analyst report, FICO Scores are used in over 90% of U.S. lending decisions.

That means that your FICO score determines not only whether you will be approved for a loan but, also the interest rate that you will be charged among other loan terms like the amount of down payment which you will need in order to be approved.

FICO, short for the Fair Isaac Company, developed the credit scoring model back in the 80’s to help lenders gauge a consumers likelihood of becoming 90 days or more past due on a loan within the next 2 years.

Ever since, lenders have been using the FICO score to objectively and consistently determine the risk of lending to a borrower.

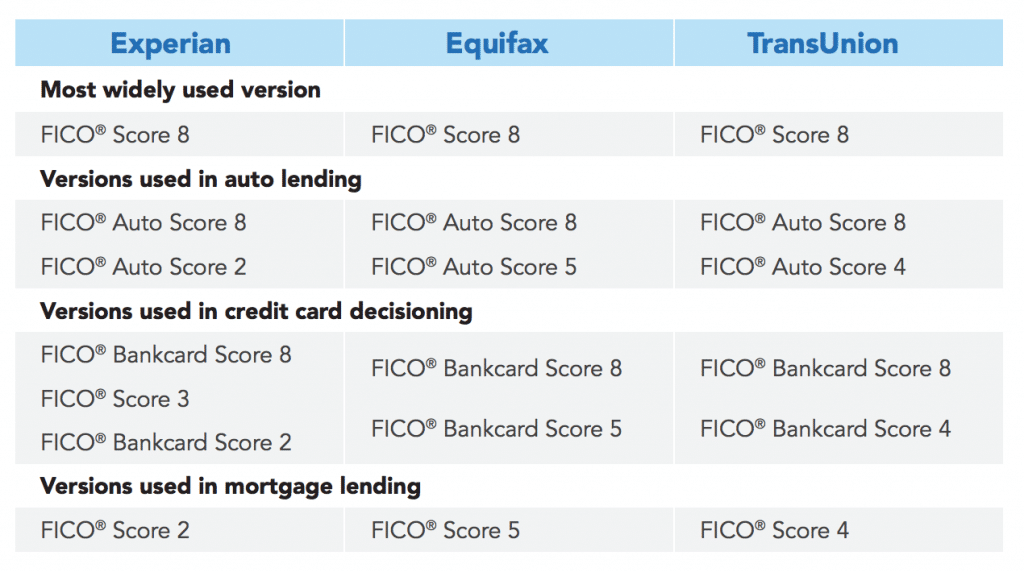

The FICO score, there are actually 49 different FICO scores, is a 3 digit number that typically ranges from 300-850 though, some industry-specific FICO scores can range from 250-900.

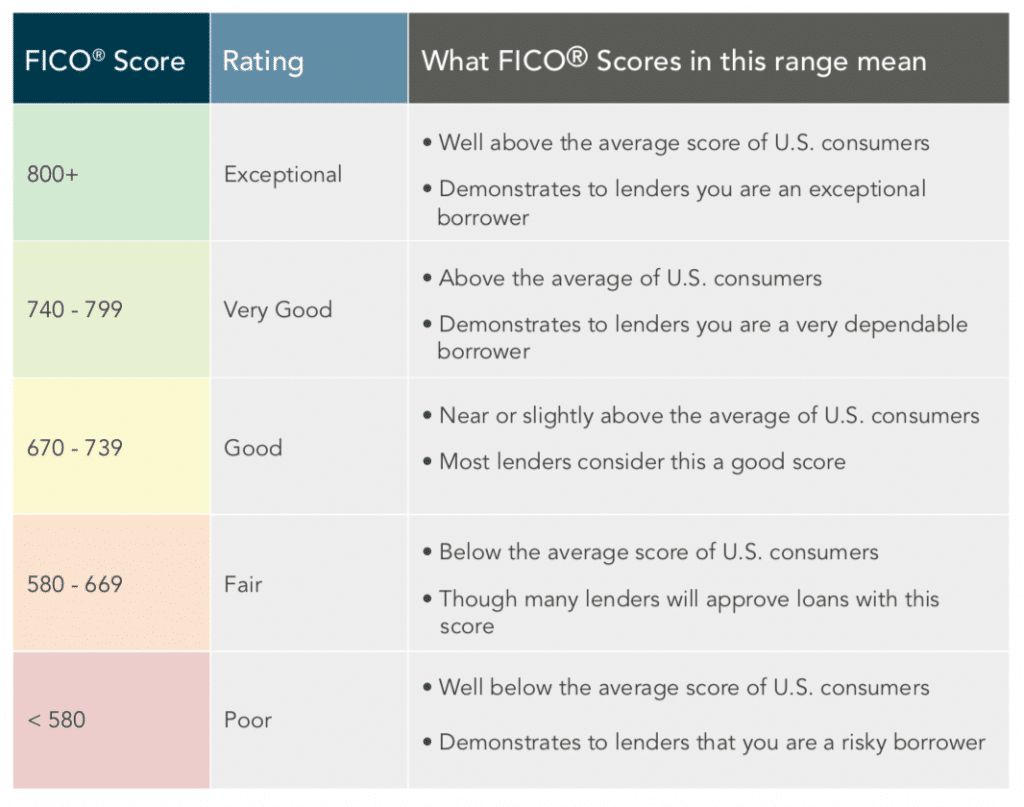

A higher FICO score represents a lower credit risk and a lower FICO score represents a higher credit risk to the lender.

The FICO scores themselves are based on the data collected from your credit reports managed by the three major credit reporting agencies (Experian, Equifax, and TransUnion).

This data is then quantified in a mathematical algorithm to determine a credit score.

Every lender has their own standards for determining what constitutes a good credit score and the terms/interest rates that they will make available to a consumer at a certain FICO credit score but, the average FICO score in the U.S. is 695 and in order to qualify for the best programs with the best terms you should set your goal for at least a 740 FICO score.

Every industry also has their own FICO scoring model setup to determine what they deem to be a creditworthy borrower.

Auto lenders care more about your previous auto lending history and mortgage lenders care more about your previous home loans, so, FICO created scores for those industries which weigh certain accounts differently.

Auto lenders use FICO Auto Scores while most credit card companies use FICO Bankcard Scores.