Frequently Asked Questions

How do I get my credit reports and scores?

Can you get my credit report for me?

Yes, if you have trouble obtaining your credit reports please contact your credit consultant and we will be happy to obtain a credit report on your behalf for free.

How do I get started?

You can get started by signing up online or by calling us at 800-750-1416.

It’s simple and takes less than a minute.

After signing up, you will be contacted by your personal credit repair consultant in order to set up your case file and get the credit repair process started.

When is my first payment?

Our credit repair services includes coaching and helping our clients understand how credit works as well as the best way of managing their credit to get the most out of their credit scores.

How do I receive updates?

You will receive updates on your credit report directly from the credit bureaus (Experian, Equifax, and TransUnion) via standard mail. These letters will contain the results of the investigations which we initiated.

You can also view your progress and receive updates via our client portal where you will be able to see what accounts we are working on, accounts that have been deleted and accounts still remaining on your credit reports.

Finally, you will also have a dedicated credit consultant who will be responsible for working on your case and communicating with you. So if you have any questions about your case you can speak directly with the person doing the actual work on your credit instead of someone who’s sitting in a call center reading notes from a computer screen.

You can communicate with your credit consultant via phone, email, and the client portal notes section.

Do you provide debt settlement services?

No, your personal credit consultant may advise you on how to negotiate with creditors and collection agencies to get the best settlement deals. But, we are not a debt settlement company and will not contact your creditors to negotiate debt.

Can a deleted account re-appear?

Once an account is deleted from your credit report it is typically permanently deleted and does not come back.

However, a creditor can petition the credit bureaus to have a previously deleted account reinserted but, the credit bureaus are required to give you notice.

If you receive such a notice, which is very rare, we can help contact the credit furnisher and credit bureaus to request the suppression of the account due to it being previously deleted.

Here’s the info from section 611 of the FCRA

(B)Requirements relating to reinsertion of previously deleted material

(i)Certification of accuracy of information

If any information is deleted from a consumer’s file pursuant to subparagraph (A), the information may not be reinserted in the file by the consumer reporting agency unless the person who furnishes the information certifies that the information is complete and accurate.

(ii)Notice to consumer

If any information that has been deleted from a consumer’s file pursuant to subparagraph (A) is reinserted in the file, the consumer reporting agency shall notify the consumer of the reinsertion in writing not later than 5 business days after the reinsertion or, if authorized by the consumer for that purpose, by any other means available to the agency.

https://www.consumer.ftc.gov/articles/pdf-0091-fair-credit-reporting-act-611.pdf

Can you help me build new credit?

Yes, your personal credit consultant will advise you on where and when to apply in order to establish credit and improve your credit scores.

Why do the credit bureaus ask for my IDs?

The Credit Bureaus request identification documents when the personal information on your credit file does not match the currently provided information (i.e. current name, address, etc…)

If there are any miss-spellings of your name, address variations, incorrect date of birth, social security number variations, the credit bureau may ask for additional documents proving your identity and current residence for security purposes.

Can I cancel my credit repair service?

Yes, you may cancel your credit repair services with CreditFirm.net at any time without any penalty or any further obligation.

Feel free to call us at 800-750-1416, email us at info@creditfirm.net, or cancel via our online cancelation form: https://creditfirm.net/signup/cancellation/

Can I repair my own credit?

Yes. You have the right to repair your own credit report, you may contact the credit bureaus third party data furnishers and credit grantors yourself.

Given time, research and study, you can do much of what CreditFirm.net does.

Many people, however, choose to hire a professional credit repair company like CreditFirm.net to fix their credit because of the experience, knowledge and know-how we bring to the table.

We have helped thousands of clients improve their credit reports; will you be our next success story? Get started today.

How long does the program last?

The program lasts as long as you decide you want us to keep working on your credit. Some clients are satisfied when they reach a credit score of 640 and cancel our services as soon as they can qualify for a mortgage. Others stay longer because they want to keep improving their credit and have higher goals in mind (750+). Our services are month to month so you keep us as long as you see fit.

Our typical client reaches their goal within 6-8 months of enrolling in our services. Having said that, we do have clients that complete our program in 2 months and others that take 12 months. How long you stay with us will depend on several variables such as your goals, the number of derogatory accounts on your credit reports, the type of accounts, the age of the accounts, and the balances of those accounts.

NOTE: If we come to a point where we have done everything that we can to improve your credit scores or we have removed all derogatory information from your credit reports we will cancel your services ourselves.

When should I start to see results?

You should see your first results within 30–45 days of enrolling in our credit repair service. Realistically, you should allow for at least 90 days to see a significant increase in your credit score.

This is due to the fact that the credit bureaus and credit furnishers are allotted a specific time-frame to complete each investigation. For example;

Credit bureau dispute: 30-45 days

Method of Verification: 15 days

Debt Validation: 30 days

CFPB Investigation: 15-60 days

etc…

Do you provide a guarantee?

It is important to understand that legal services are not guaranteed.

Just like in a court of law where an attorney could never guarantee a client that a judge or jury would find in their favor. A credit repair company cannot guarantee that a creditor, third party data furnisher or credit bureau will find in your favor.

Ultimately, the credit bureaus make the final determination on what is reported and what is deleted and the only ethical guarantee that CreditFirm.Net can make is that we will advocate as best as we can on your behalf to reach a favorable resolution.

Are there any additional fees?

No, CreditFirm.net does not charge any additional fees.

No consultation fees.

No credit report fees.

No cancelation fees.

No fees for any additional services.

– – –

$49.99 a month for 1 person

$89.99 a month for 2 people (Save $10 a month)

Can I prepay for my credit repair services up front?

No. Paying for credit repair services upfront, before the service has been rendered, is illegal per the Credit Repair Organizations Act (CROA). Credit Repair companies accepting payment before performing services are violating the law.

CreditFirm.Net does not accept payment in advance. All fees are charged in arrears for services rendered.

Is Credit Repair Legal?

Yes, credit repair is legal as long as the company performing the credit repair service is a state registered credit services organization and follows the Credit Repair Organization Act (CROA), as mandated by the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB).

CreditFirm.Net complies with all State and Federal regulations to offer legal credit repair services.

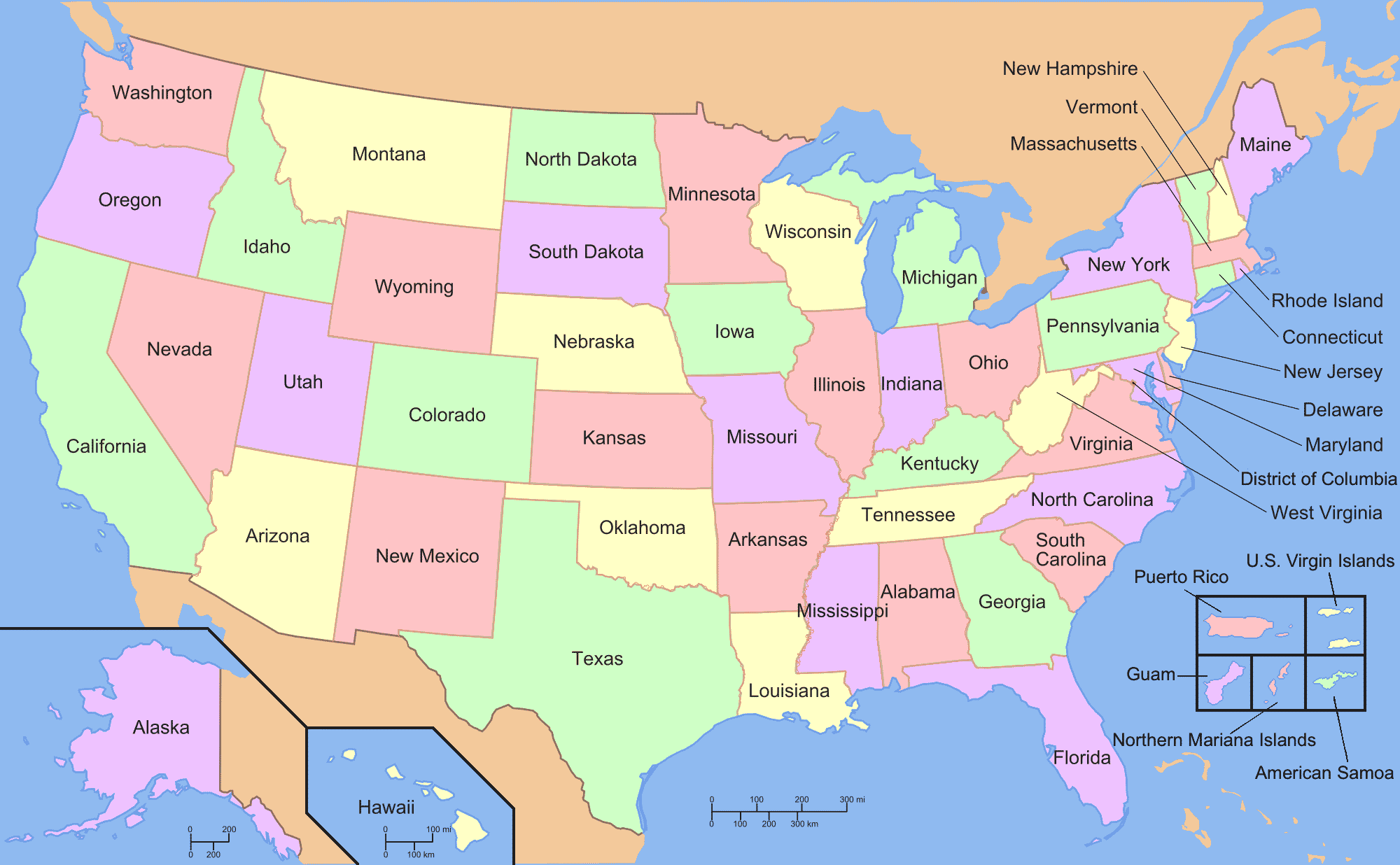

What States Do You Service?

CreditFirm.net can help clients within all 50 states as well as U.S. territories including Puerto Rico.

Why should I repair my credit?

Bad credit affects every aspect of your life.

Everything from whether you can get a job, get approved for a credit card, qualify for an auto loan, mortgage, even your insurance premium is impacted by your credit.

Hiring a professional to fix your credit by doing all of the work for you saves you time and money.

Put CreditFirm.net to work for you today, Sign Up Now for only $49.99.

Do you have a couples rate?

Yes. Our couples rate is $89.99 a month, which saves you $10 a month off the regular rate.

Plus, you don’t have to be a couple to get the discount.

Any 2 people can sign up under the couples rate and get the discount.

You can sign up for the couples rate via the following page: https://creditfirm.net/signup/couples/

When will the letters to the credit bureaus be mailed out?

The letters to the credit reporting agencies (Experian, Equifax, and TransUnion) are usually mailed out within 24-48 hours of receiving your credit reports.

When will I receive my portal login?

You will receive your portal login as soon as we have processed your information, entered your accounts into our system, created an action plan, and started contacting the credit reporting agencies and credit furnishers.

This is typically 24-48 hours after receiving your credit reports.

Do you assist people with coaching?

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.