How your FICO Credit Scores are Calculated

There are three major credit reporting agencies in the U.S. – Experian, Equifax, and TransUnion.

These credit reporting agencies, sometimes referred to as credit bureaus, maintain records of your credit data as well as other personal information such as your name, aliases, addresses (both current and previous), phone numbers, employers, date of birth, social security number, etc….

This collective data gathered on you is referred to as your credit report.

Each credit bureau maintains their own credit report which means that you have a separate credit report with Experian, Equifax, and TransUnion.

When you apply for a loan, open a new account, make a payment, miss a payment, etc…, that information is reported from your credit lender to the credit reporting agencies.

Due to the fact that credit reporting is 100% voluntary, some lenders may only end up reporting the data to one or two of the three bureaus or reporting the data at different times/dates which may cause you to have differing information on your credit reports and in-turn cause variations in your credit scores.

Here’s more detail on why your credit scores differ.

Now, let’s take a look at the basic information reporting in your credit reports.

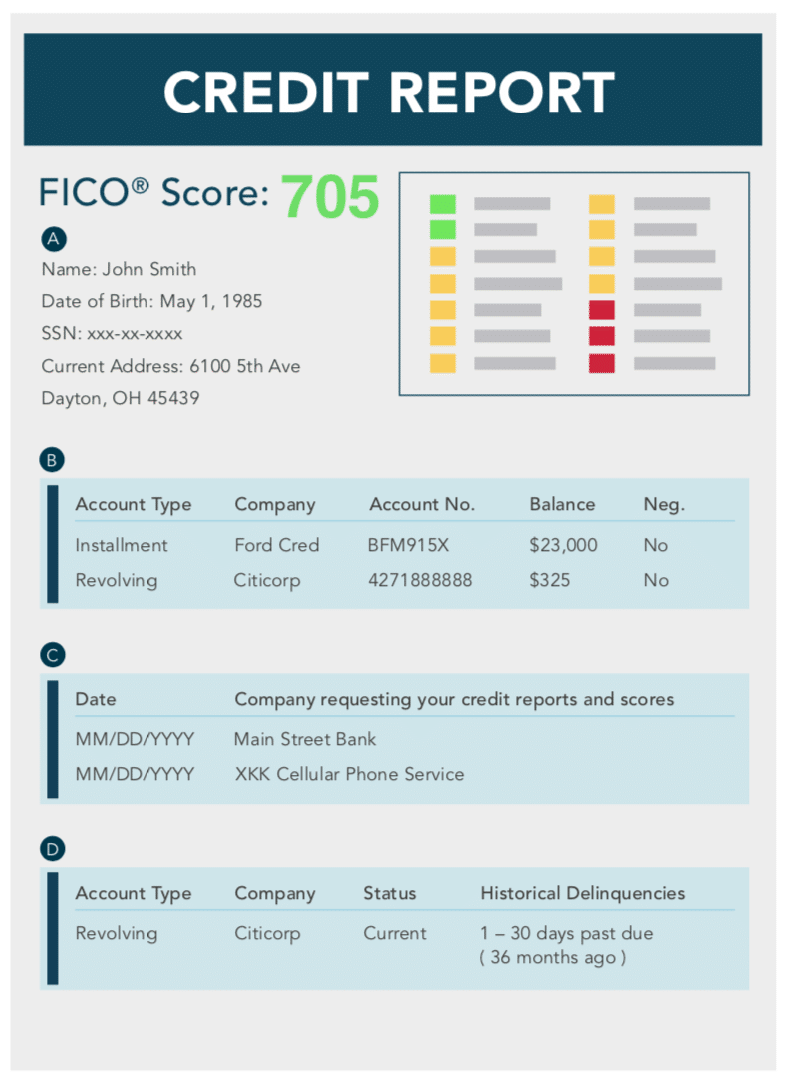

A. Personal Information

Credit reports display the personal information such as your name, aliases, address (both current and previous), social security number, date of birth, employer (both current and previous), phone numbers, etc…. It is important to note that personal information does not impact your FICO scores.

B. Account Information

Credit reports display your credit accounts (both active and closed). Each account is reported as a trade-line which contains approximately 40 data points of information such as the date the account was opened, date closed, balance, credit limit/high credit, status, payment history, ECOA code, comments/remarks, address identification code, etc…

C. Inquiry Information

Credit reports also display requests for your credit file from the past 2 years, also known as inquiries. There are 2 different types of inquiries, hard inquiries which impact your credit scores and are applications for credit initiated to obtain credit Soft inquiries do not impact your credit scores, they are “account review” inquiries initiated either by yourself when checking your own credit or by creditors to may wish to send you a pre-approved offer of some sort. Soft inquiries DO NOT impact your FICO scores.

D. Derogatory Information

Your credit report also displays any past delinquencies reported by your creditors or third party data furnishers such as collection agencies. This information includes late payments, past due balances, collections, charge-offs, repossessions, as well as public record information such as judgments, tax liens, and bankruptcy.

This data is then plugged into one of the FICO scoring algorithms which then calculates a score to determine your creditworthiness.

NOTE: The FICO score’s original goal was to determine a consumer’s likelihood of becoming 90 days or more past due on a loan within the next 2 years. This is why the payment history and account activity from the last 2 years has the most impact on your credit score.

As the information and data in your credit report change so do your FICO credit scores.

FICO scores are calculated on request and considering that data on your credit reports is constantly changing, your FICO credit score will reflect those changes.

More Information

What are FICO Scores?

5 Components of your FICO credit scores

Why are your credit scores different

Why your FICO credit scores matter