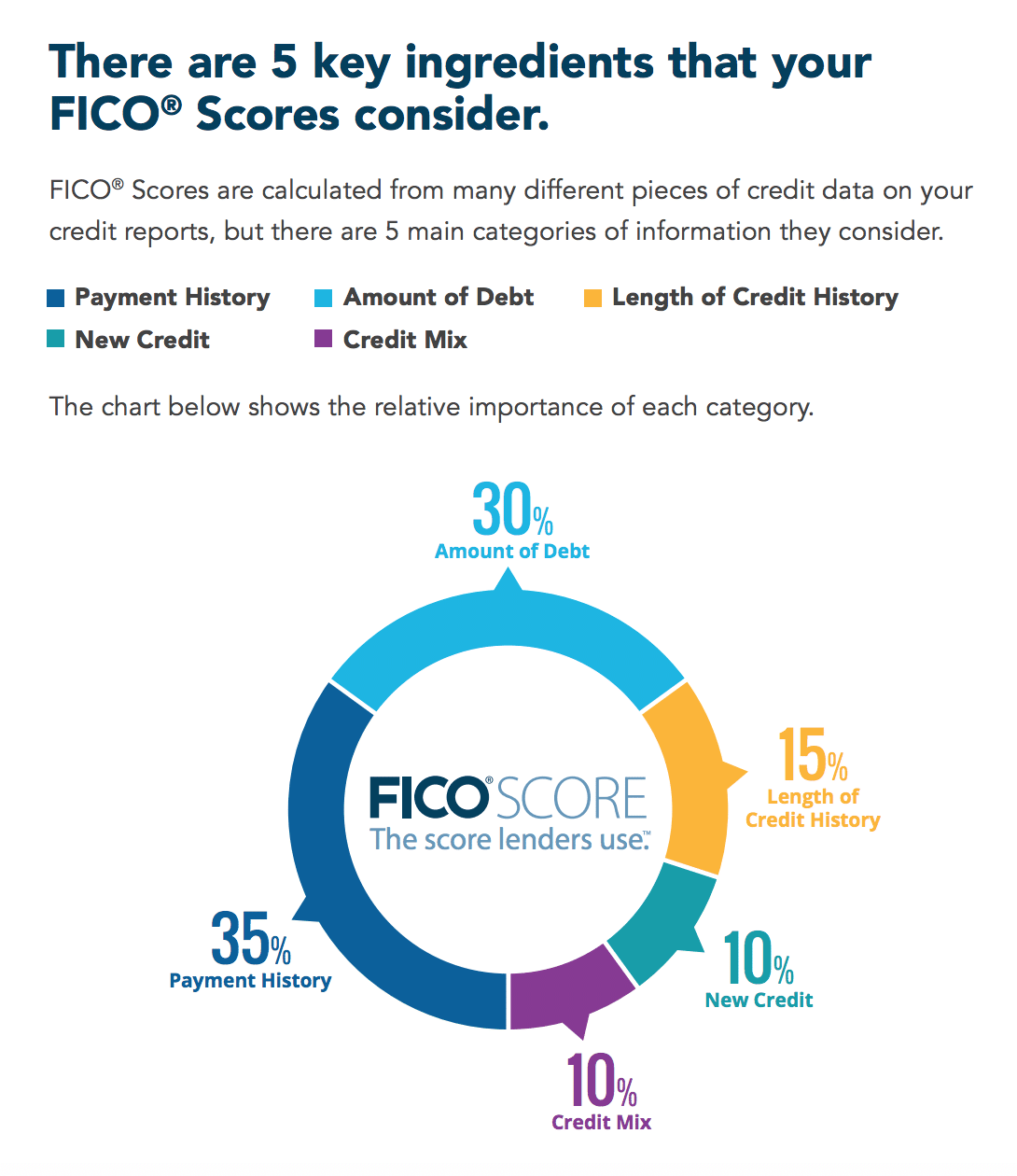

5 Components of Your Credit Scores

Your FICO credit scores are aggregated from all of the data reporting in your credit reports but, there are 5 main components to your credit scores.

NOTE: The percentages may vary depending on the information in your credit reports. If you don’t have any open and active accounts from which to calculate a credit utilization, your payment history may have an even greater influence on your credit scores than just 35%.

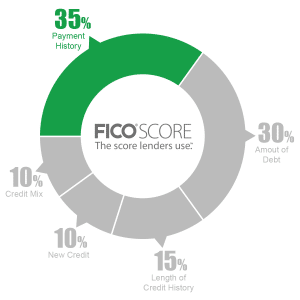

Payment History – 35% of Your FICO Credit Score

The most important factor in calculating your credit score is your ability to repay your debt on time.

Delinquencies such as late payments, charge-offs, collections, etc… will lower your credit scores.

The more serious the delinquency, the more frequent and recent it is, the lower your scores.

FICO scores consider your payment history from credit cards, store cards, installment loans such as auto loans, mortgages and student loans as well as your public record information in the form of court judgments, tax liens, wage garnishments, and bankruptcy and third-party furnishers such as collection agencies.

Their impact your FICO score varies depending on;

• the severity of the late payments (90 day late payments hurt your credit scores more than a 30 day late).

• The frequency of the late payments (2 late payments sporadically spread out over the course of a few years doesn’t hurt your credit scores as much as a string of 8 late payments reporting one right after the other).

• The recentness of the delinquency (A late payment from 2 months ago will hurt your credit score much more than a late payment from 5 years ago).

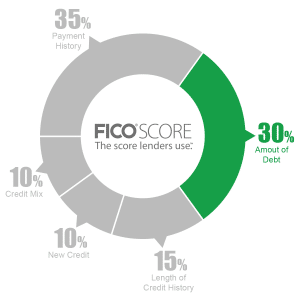

Credit Utilization – 30% of Your FICO Credit Score.

The amount of credit that you are using in relationship to the amount of available credit you have is a very important factor when calculating your credit score. Ideally, your balance should be at or below a credit utilization of 30%, which means that you would have 70% available credit.

For example, if you had a credit card with a $1,000 credit limit, your balances should never exceed $300 (30%).

If you’re close to maxing out your accounts, lenders will view you as a high-risk borrower because you might have trouble making payments in the future.

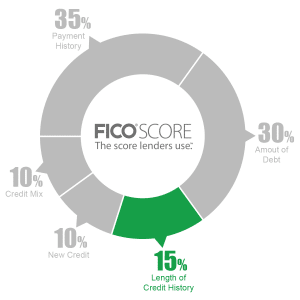

Length of Credit History – 15% of Your FICO Credit Score.

The FICO credit algorithm, like most scientific formulas, believes that the more data they have, the more accurate the results will be.

This is why the age of your oldest account, the average age of all your open accounts and the age of specific types of accounts (installment and revolving) has such a large impact on your credit scores.

The longer your credit history and the older your average age of open accounts, the higher the scores.

This is why it is so important to continue building and growing your credit history and not close your oldest accounts.

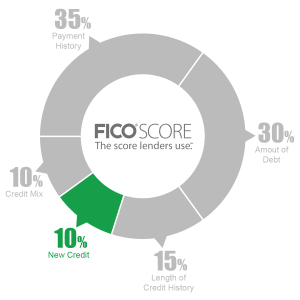

New Credit – 10% of Your FICO Credit Score.

The amount of new accounts that you have recently opened and your recent applications (inquiries) for multiple new credit lines accounts for 10% of your credit score.

Opening or applying for several new accounts in a short period of time indicates greater credit risk which lowers your FICO score.

Limit yourself to one inquiry every 6 months and don’t open too many accounts at once.

Mix of Credit – 10% of Your FICO Credit Score.

FICO considers the fact that most lenders want to make sure that you can manage different types of credit accounts simultaneously.

These include both revolving and installment accounts such as credit cards, retail accounts, installment loans and mortgage loans.

Having a varied mix of credit on your credit reports will increase your credit scores and conversely, having only one type of account or none at all will lower your scores.

Manage your credit correctly and your credit scores WILL increase.

Just make sure that you check all 5 boxes and pay your bills on time, carry a low credit utilization rate, grow your credit history, limit your inquiries and have a good mix of credit.

What are FICO Scores?

How your FICO credit scores are calculated

Why are your credit scores different

Why your FICO credit scores matter