How Many FICO Scores Are Out There?

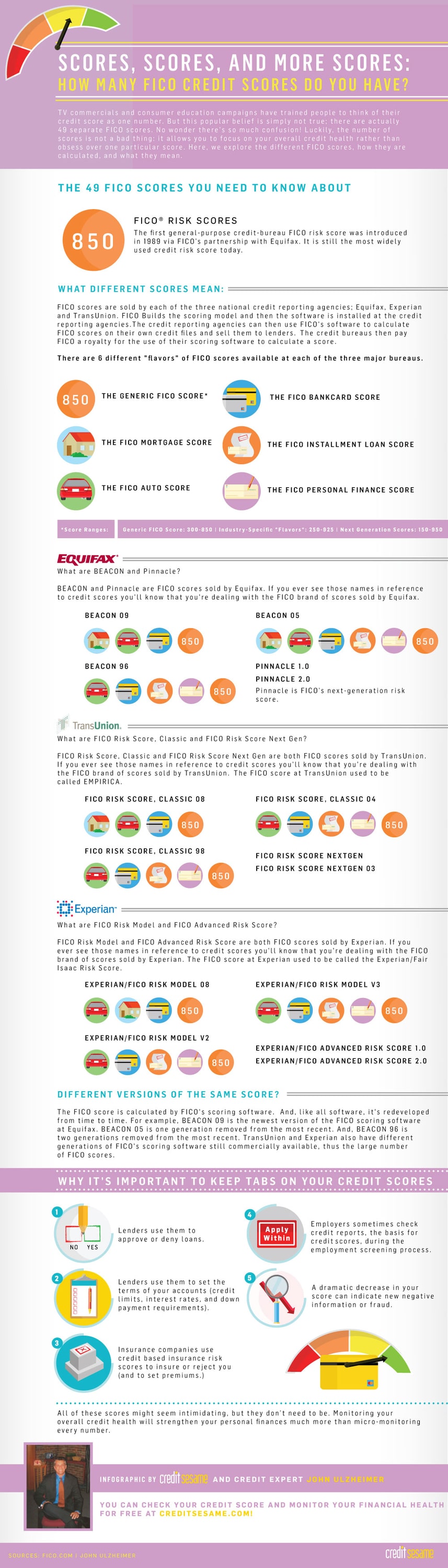

You have undoubtedly heard about the importance of maintaining a good credit score, more exact a good FICO score, the score developed by the Fair Isaac Company to determine the creditworthiness of a potential borrower for lenders. In reality, it’s not just about maintaining a good FICO score, it’s about maintaining good FICO scores (plural).

All 49 of them.

Yes, you heard me right, there are actually 49 different FICO scores out there. Not to mention the thousands of personal credit scores created by everyone from the Credit Bureaus to Credit Card Companies to Banks.

FICO has many different types of scores, depending on the type of loan you’re applying for. In fact, John Ulzheimer, a credit expert, has created a great chart showing a total of all 49 different FICO scores.

Why so many?

The Fair Isaac Company (FICO) has the basic formula known as the General Purpose FICO, which is used to calculate a consumer’s creditworthiness for all types of loans. The data which FICO uses to calculate their scores comes from the three major credit reporting agencies (Experian, Equifax, and TransUnion).

FICO uses this raw data to create a single, three-digit score for each credit bureau. This means that there are three versions of the General Purpose FICO score to start.

FICO also has several other credit score formulas customized for the specific types of loans, such as auto loans, mortgages, and credit cards. Each of these is then re-branded and specially customized for each credit bureau. Finally, each formula may have multiple releases and updates, which are used at the lender’s discretion. And this is how we have 49 FICO scores.

This issue is currently being reviewed by the Consumer Financial Protection Bureau (CFPB), because each year consumers pay millions of dollars for credit scores from various websites but get a generic FICO or other credit scores which may be seemingly useless because the scores may vary by over 100 points.

So the next time you check your credit score, take the time to find out exactly what type of credit score it is, and whether or not it of any value.