Monday Mailbag 9/3/2018

Question

I have been threatened via email about a debt that I don’t recall ever asking for or getting. Tomorrow, they said they are issuing a warrant with my local police and serving me a summons. I am afraid of this and don’t know what to do.

Answer

Legitimate collection agencies are bound to work within the confines of the FDCPA (Fair Debt Collection Practices Act). Collection agencies CANNOT get warrants issued against you for debt and are legally bound to provide you a 30 day written notice when they acquire your debt.

This email sounds like a scam.

If it’s a legitimate debt which is still within your state’s statute of limitations and they summon you to court, you will have the opportunity to validate the debt and receive all of the original paperwork from the original creditor (including the original contract you signed when you established the debt) to find out what the debt is for.

Don’t panic and DO NOT send any money to this company.

Question

Is a Credit Score of 600 good or bad?

Answer

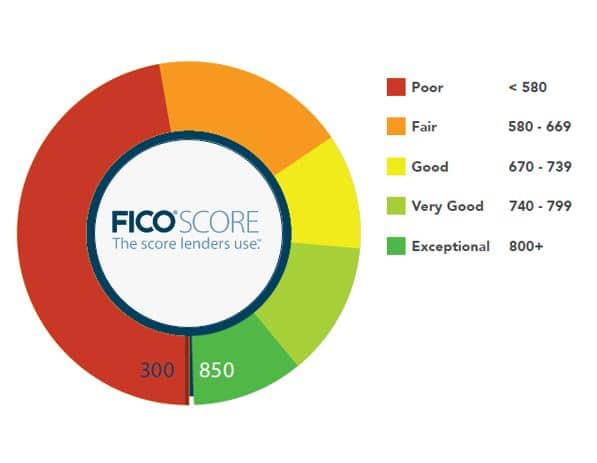

A 600 credit score could be either poor or fair depending on the credit scoring model used to calculate the score.

Most credit scores (FICO & VantageScore v3.0) have a range of 300–850 with a few industry-specific FICO scores ranging from 250–900 and other scores like Sagestream ranging from 1–999 and VantageScore v2.0 ranging from 501–990.

For the sake of simplicity, let’s assume that your score of 600 is a FICO score, the most common credit scoring model and the model used in 90% of lending decisions.

A 600 FICO score is considered to be in the Fair range which means that you can probably qualify for a mortgage or auto loan but, the terms and interest rates won’t be that great.

Based on some information which we received from mortgage lenders and auto dealers, your FICO score should be at least 740 to qualify for tier 1 auto loans and mortgages.

To increase your scores you will want to work on optimizing the 5 factors used to calculate your credit scores, which are:

Payment History – 35%

Credit Utilization – 30%

Length of Credit History – 15%

Mix of Credit – 10%

New Credit/Inquiries – 10%

To get the most out of your credit scores and increase them, you should pay your bills on time, work on paying down your credit cards to a credit utilization of 20% or less, keep your oldest accounts open and active to establish a long length of credit history.

Don’t open too many accounts at once and incur too many inquiries, in fact, you want to try and limit yourself to 1 inquiry every 6 months.

Carry a good mix of credit which includes both installment and revolving accounts.

Finally, if you have and past delinquencies or accounts reporting derogatory statuses like collections, late payments, charge-offs, repossessions, tax liens, judgments, bankruptcies, foreclosures, etc… you will want to work on removing them from your credit reports by leveraging consumer protection laws such as the FCRA, FCBA, FDCPA, etc….

You can’t magically remove all negative information from your credit reports with the wave of a wand but, if you investigate the derogatory information, validate the debt, complete method of verifications requests, permissible purpose verification, goodwill requests, etc… you can do some damage to the negative information and improve your scores.

You can perform all of this work yourself but, make sure that you understand that the process takes time and can be quite time-consuming. You have to be organized, diligent, and stay on top of everything.

You can also choose to hire a credit repair company to handle all of the work on your behalf to work on removing the derogatory information and advise you on the best way to manage your credit to get the most out of your credit scores.

We would be honored to have the opportunity to work on your credit reports, increase your credit scores, and help you reach your financial goals.