What Do Americans Know About Credit?

The Consumer Federation of America (CFA) and VantageScore Solutions have recently released their annual survey examining how much consumers actually know about their credit scores.

1,000 Americans were surveyed on their knowledge of how credit scores are calculated, where and how to obtain credit scores/reports, how to best manage their credit and what to do to improve their credit scores.

The results were pleasantly surprising, revealing that consumer knowledge of the credit industry and credit scores have increased overall.

Let’s take a look at some of the key findings from the survey.

The number of consumers who have viewed their credit scores at least once in the past year has increased from 49% to 57%.

Although the 8% increase is a great step in the right direction, I find it strange that 43% of the individuals surveyed have not inquired about their credit scores at least once in the last year.

With the availability of free credit reports and scores at all-time highs and the ability to get your credit information at will from credit card companies and credit monitoring services like Credit Karma, Credit Sesame, Quizzle, Nerd Wallet, Wallet Hub, etc… not to mention directly from the 3 credit reporting agencies (Experian, Equifax, and TransUnion).

Everyone in the US should be checking their credit on a monthly basis.

So although it’s great news that the numbers have increased, the fact that a case of Identity Theft occurs once every 2 seconds makes us hope that the number of consumers that check their credit at least once a year gets up to 100% sooner rather than later.

The majority of the individuals surveyed who did check their credit scores were potential borrowers were planning on applying for a loan in the near future. These individuals also demonstrated an increased knowledge of credit when compared to consumers with no plans to use their credit.

This tells us that unfortunately, people only care about their credit when they need it. But, by that time it may be too late. It’s much easier to spend 15 minutes a month on reviewing your credit and making sure that everything reporting in your credit report is 100% accurate and reporting correctly instead of stressing out over issues you located in your credit report as you were applying for a loan.

With the recent data breach at Equifax where 143 million credit files were compromised containing names, dates of birth, social security numbers, addresses, phone numbers, and tradeline information; Identity Theft has never been more of a reality.

On top of the risk for identity theft, 79% of credit reports contain errors. Although these errors may seem rather small and insignificant on the surface, according to a recent report from the Federal Trade Commission, 20% of credit reports contain errors that impact your credit scores enough to increase the consumer’s credit risk tier, making them less likely to be offered a higher interest rate.

Checking your credit every month is as important as paying your bills on time.

The CFA also found that a large part of the consumers surveyed was able to identify 3 factors used to calculate a credit score. Payment History, Credit Utilization, and Public Records such as Bankruptcy.

Several incorrect factors were also commonly listed as having an impact on credit scores including marital status, age, and income. These factors DO NOT impact your credit scores.

It is important to understand what factors are used to calculate your credit scores in order to increase them.

Several of those who were surveyed were able to get one or two of the factor used to calculate a credit score but, few were able to get all 5.

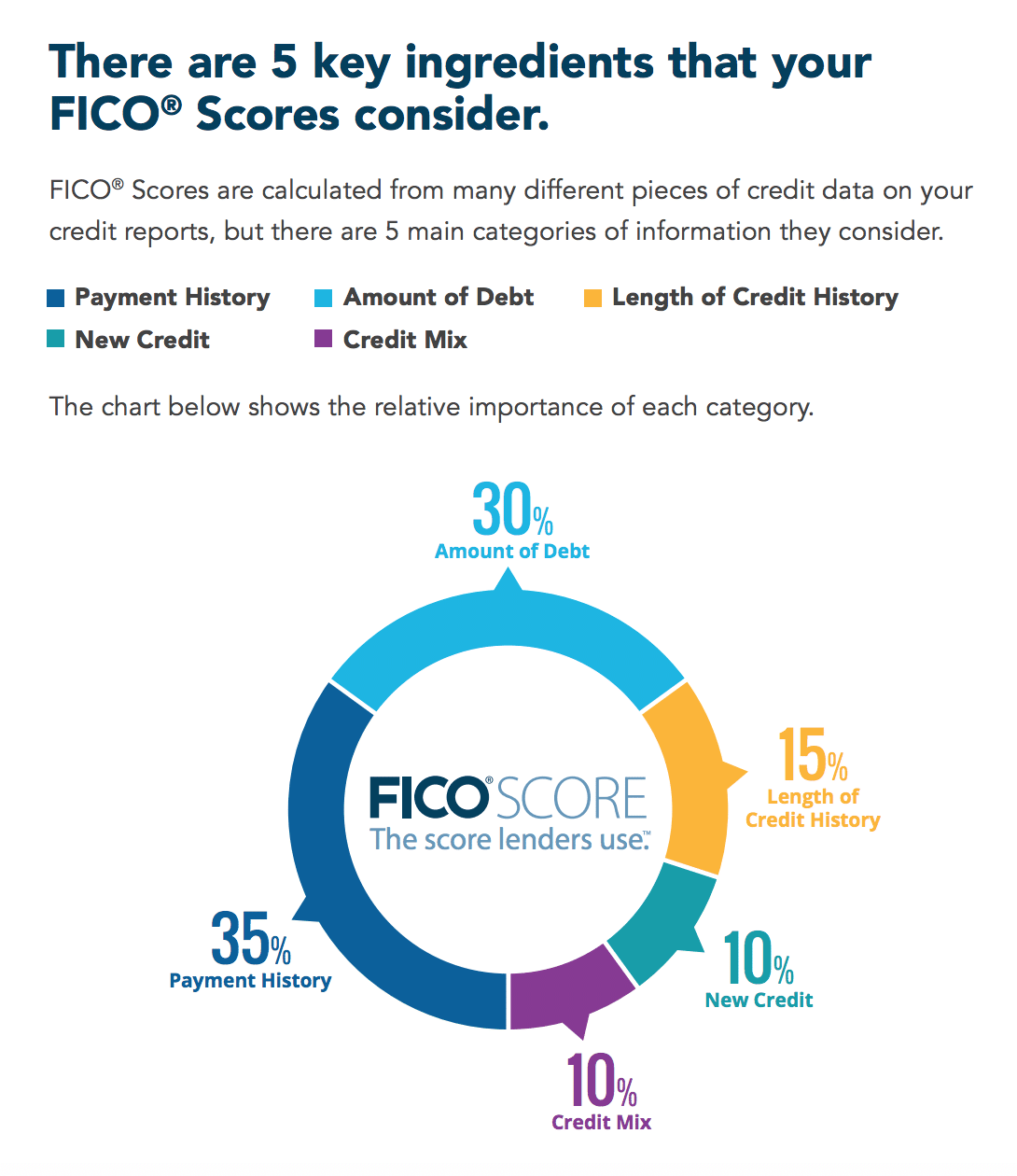

For your records, there are 5 main factors used to calculate your credit scores.

Payment History – 35% of your credit score.

Credit Utilization – 30% of your credit score.

Length of Credit History – 15% of your credit score.

Mix of Credit – 10% of your credit score.

New Credit/Inquiries – 10% of your credit score.

These findings suggest that Americans are more curious and knowledgeable about their credit than ever before, especially if they are interested in applying for a loan in the near future.

However, there’s still a long way to go.