How to Increase Your Credit Scores

If you’ve ever been denied credit or are being charged high-interest rates for a mortgage, auto loan, or credit card, it may be time to take a look at your credit scores.

Your credit score, a history of how well you repay debt, determines your creditworthiness and in most cases determines whether you are qualified for a loan as well as the rate of interest that you will be charged.

A high credit score guarantees the best rates and terms on loans, while a low score almost always means that you will end up paying 3 to 5 times more for a loan than someone with good credit.

Increasing your credit score can change your life by saving hundreds of thousands of dollars in interest fees and giving you access to capital to buy your own home, buy a car, and even start a business.

Increasing your credit scores doesn’t happen overnight, it’s a long painstaking process that takes time, patience, organization, and a knowledge of consumer protection law. This is why it’s so important to start planning for the future and working on improving your credit scores well in advance of when you will need it.

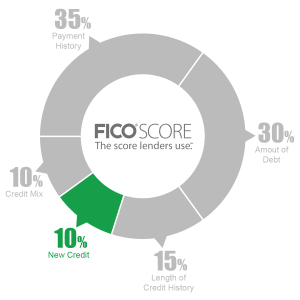

To increase your credit scores, you will want to work on the following five factors.

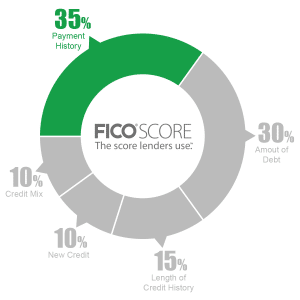

Payment History – 35% of Your Credit Score

Paying your bills on time is the best way to ensure a high credit score. Late payments, collections, repossessions, and other derogatory and delinquent information will bring down your credit scores. If you have derogatory information reporting on your credit report, it is important that you get proactive and work on removing as much of it off your reports as possible. You can also hire a credit repair service to leverage consumer protection statutes given to you by FACTA, FCRA, and FDCPA to legally remove negative accounts from your reports.

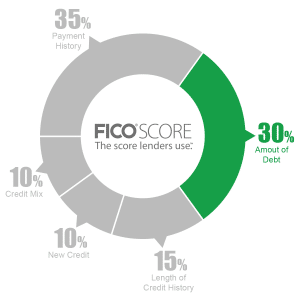

Amounts Owed – 30% of Your Credit Score

The utilization rate of your credit cards, also known as the balance to credit limit ratio, makes up approximately 30% of your credit score. Keep your credit card balances at or below a 20% utilization rate to maximize your credit scores.

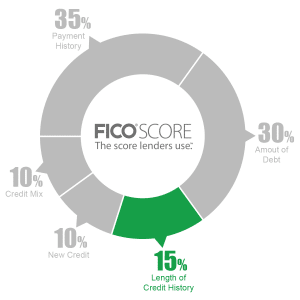

Length of Credit History – 15% of Your Credit Score

The average age of your open accounts makes up 15% of your credit score. Keep your oldest accounts open as long as possible and your scores will increase. Those with a short length of credit history are penalized because they have not had credit for very long while those with a long length of credit are benefited from a higher score.

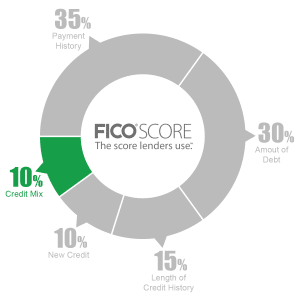

Mix of Credit – 10% of Your Credit Score

Maintaining a good mix of revolving accounts (credit cards) and installment accounts (accounts with a set length of term like auto loans, mortgages, and student loans) will increase your credit scores by showing lenders that you can maintain and use both types of accounts.

New Credit – 10% of Your Credit Score

Every time you apply for credit, an inquiry reports to your credit report. These inquiries represent a history of all of your applications for credit over the course of the last 2 years. Too many inquiries will lower your credit score and make you look like you’re desperate for credit. Ideally, limit yourself to no more than one inquiry every 6 months.

CreditFirm.Net has helped thousands of consumers just like you remove negative information from their credit reports and improve their credit scores by leveraging consumer protection statutes like the FACTA, FCRA, FDCPA, HIPAA, and more.

Since 1997, CreditFirm.Net has helped our clients purchase homes, get low-interest auto loans, and save millions of dollars by improving their credit scores.