Credit Score FAQ

Credit Scores don’t have to be complicated.

Here is a quick FAQ of some of the common questions consumers have about their credit scores.

What is a Credit Score?

A credit score is a 3 digit number which typically ranges from 300-850 but, can range from 250-900 or 501-990 depending on the scoring model, which is used by lenders to determine your creditworthiness for home loans, auto loans, student loans, personal loans, business loans, credit cards, and even insurance premiums.

Credit Scores are aggregated from the information contained within your credit reports which are maintained by Experian, Equifax and TransUnion.

What is a FICO Score?

A FICO Score is the most popular credit scoring model used today. 90% of lending decisions are based on FICO scores.

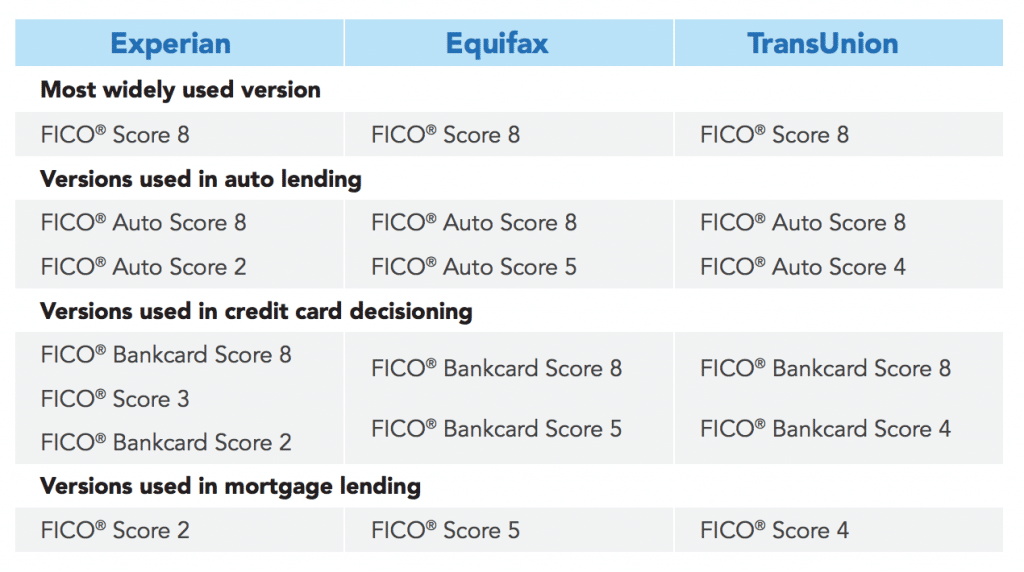

There are different FICO scoring models used by the mortgage industry, auto lending industry, insurance industry, credit card industry, etc….

There are actually 49 different FICO scores with different scoring models and variances.

Do I have more than one Credit Score?

Yes. There are dozens of different credit scores like the VantageScore v3.0, v2.0, Plus Score, TransRisk Score, Power Score, and many more including 49 different FICO scores.

On top of this, your scores are calculated based on the information contained within your credit reports, of which you have 3 (Experian, Equifax, and TransUnion).

So your Experian VantageScore will be different form your TransUnion VantageScore which will be different from your Equifax VantageScore.

How are my Credit Scores calculated?

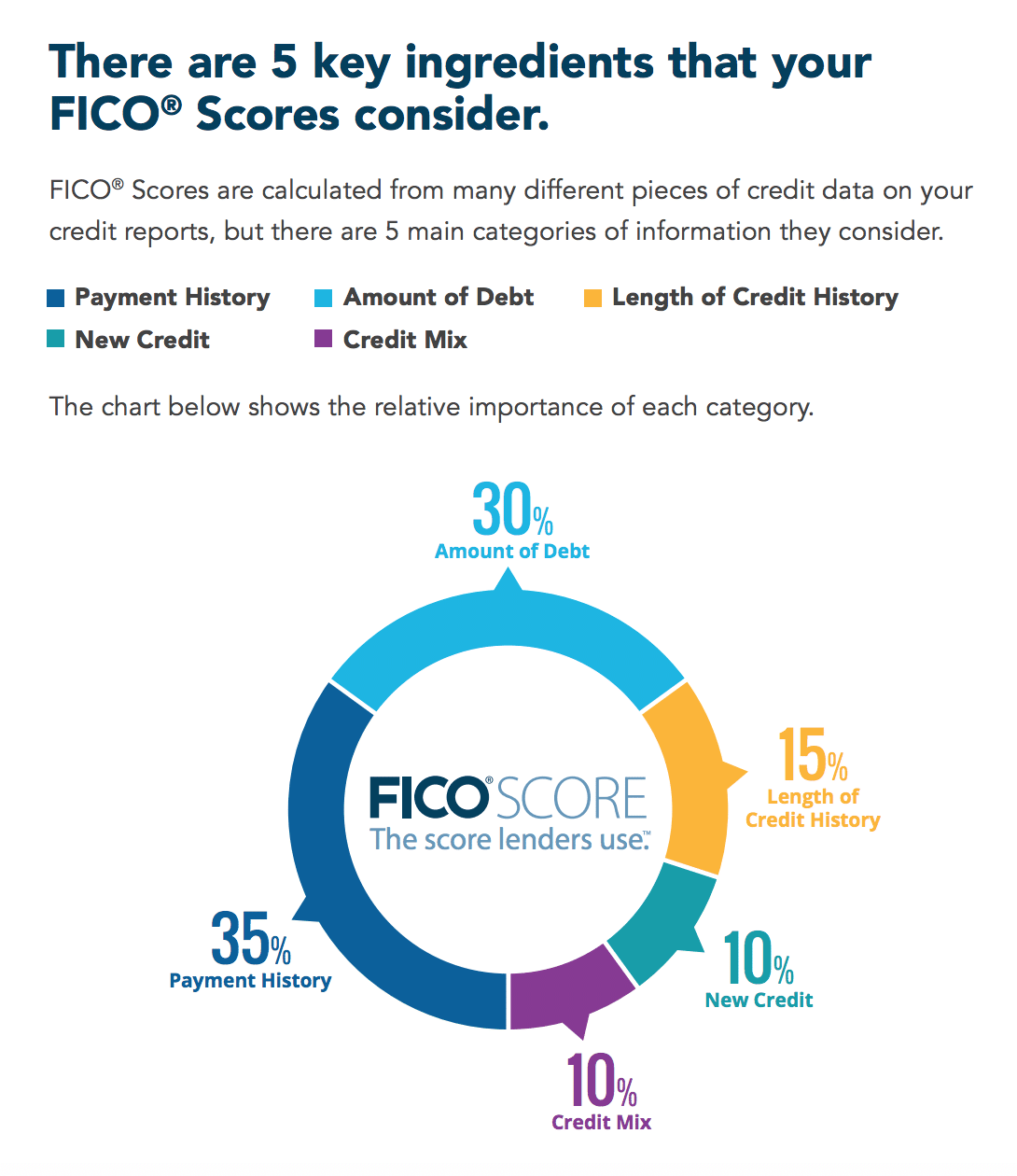

Your credit scores are calculated from the information contained in your credit reports.

There are 5 main factors considered in determining your credit score.

35% – Payment History

30% – Credit Utilization

15% – Length of Credit History

10% – Mix of Credit

10% – New Credit/Inquiries

What is a good Credit Score?

Credit Scores typically range from 300-850 with some models ranging from 250-900 or 501-990 but, those are outliers so, let’s focus on the most common credit scoring range, 300-850.

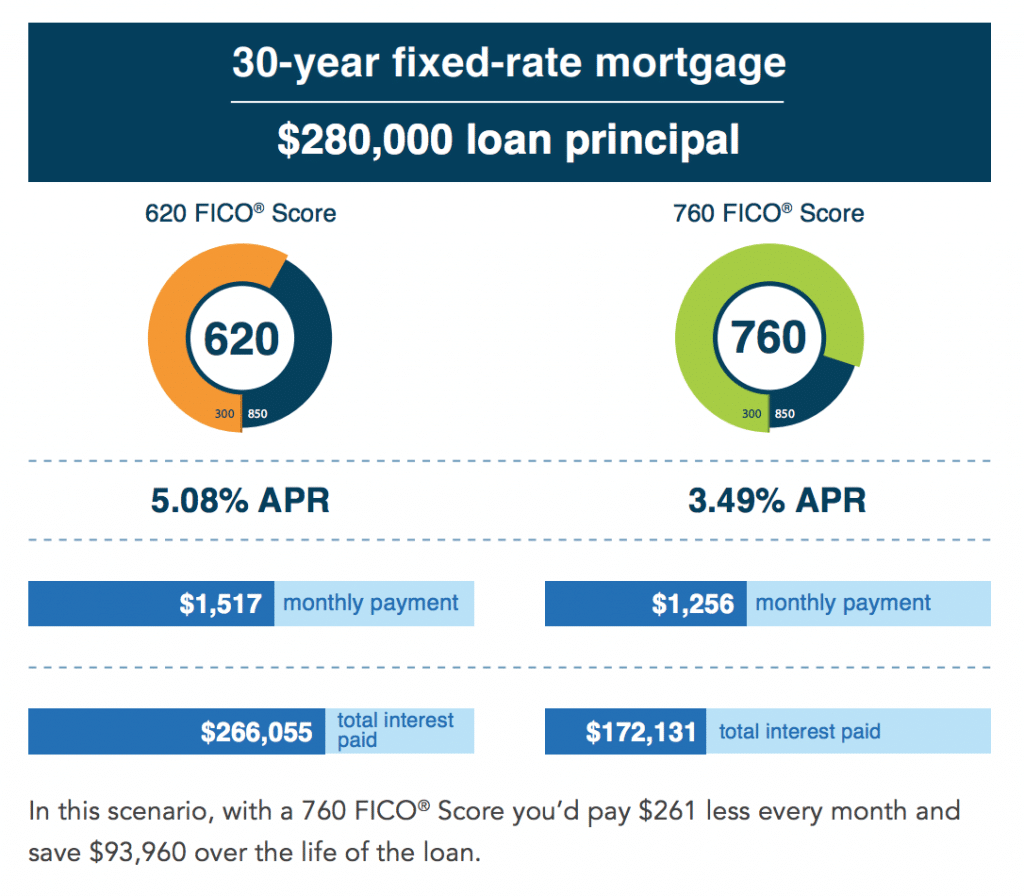

Higher credit scores demonstrate a higher degree of creditworthiness and less risk to the lender while lower scores demonstrate a smaller degree of creditworthiness and a higher lending risk.

According to Experian, the average credit score in the US is 691 so try to get your scores above that. Here’s a chart of what the Fair Isaac Company (FICO) deems to be a good credit score.

Does income factor into Credit Scores?

No. There are a myriad of factors which are used to calculate your credit score but, your income is not one of them.

You can have a great credit score no matter how much your income is.

Other factors that do not impact your credit scores are your age, gender, race, education, employment, address, or marital status.

What do I have to do to get a high Credit Score?

Here’s a quick list of actions that you can take to improve your credit scores.

Pay your bills on time

Maintain a low credit utilization

Limit your credit applications to 1 every 1 months

Don’t close your oldest accounts

Keep a good mix of credit

Follow these 10 Credit Commandments to increase your credit scores.

Where can I get my Credit Scores?

You can access your credit scores for free via sites like CreditKarma or CreditSesame but, keep in mind that these scores will be VantageScore v3.0.

You can also get an Experian FICO score from sites like Discover but, it will be just one of the 49 FICO scoring models.

The best place to get your FICO credit scores is at myFICO.com where you can access 28 different FICO scores.