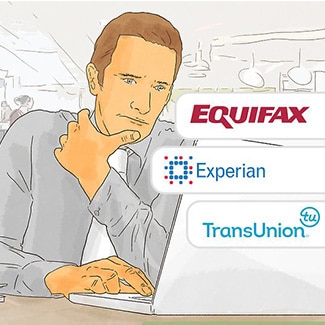

Call the following toll free numbers of the three credit reporting agencies (Transunion, Experian, and Equifax) and request for an initial fraud alert to be placed on your credit report. Once the credit bureau confirms your fraud alert, they will forward that information to the other credit bureaus.

By initiating this process, lenders are required to contact you by phone to authorize any new lines of credit.

All three credit bureaus (Transunion, Experian, and Equifax) will provide you a credit report free of charge per government mandate.

TransUnion:

1-800-680-7289

www.transunion.com;

Fraud Victim Assistance Division, P.O. Box 6790, Fullerton, CA 92834-6790

Equifax:

1-800-525-6285

www.equifax.com;

P.O. Box 740241, Atlanta, GA 30374-0241

Experian:

1-888-EXPERIAN(397-3742);

www.experian.com;

P.O. Box 9554, Allen, TX 75013

As soon as you receive your credit report, go over all of the information and highlight any accounts affected by the identity theft.

Look for inquiries from companies you haven’t contacted, accounts you didn’t open, and debt on your accounts that you don’t recognize. Check personal information reported on the credit report: Social Security number, addresses, names, and employers. If you find any inaccurate information the credit bureaus have to be notified right away.