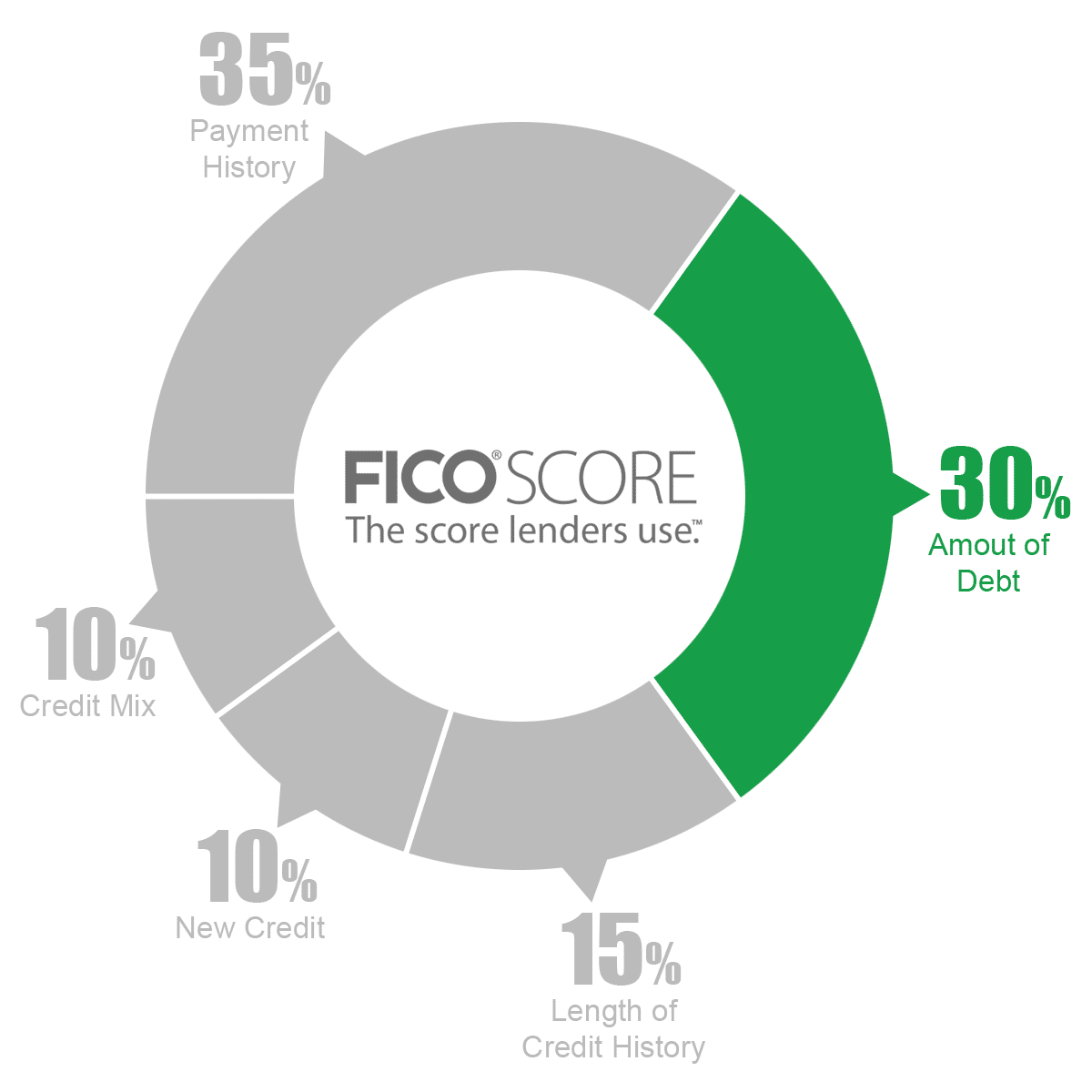

AMOUNTS OWED

30% of Your Credit Score

30% of your overall credit score is calculated from the amount of credit you’re using and how much debt you owe.

This includes;

Credit utilization ratio on revolving accounts

Remaining amount owed on installment loans

Amounts Owed

The two most important parts of amounts owed is the available credit on revolving accounts (credit cards) and proportion of installment amount owed in relation to the original loan amount.

The balance owed on installment accounts, such as mortgages and auto loans, should ideally be 49% or less of the original loan amount.

Considering the difficult nature of paying down an auto loan or mortgage this is the most difficult aspect of the FICO score to control but, no one expects you to pay down half your mortgage to boost your scores a bit.

This is why the largest part of “Amounts Owed” focuses in on your revolving credit utilization.

Revolving Credit Utilization

The amount of revolving debt you owe (current balance) in relation to the amount of debt you can borrow (credit Limit) is your credit utilization.

For example, if you have a credit card with a $1,000 limit and you carry a balance of $200 on it, your credit utilization is 20%. This also means that your available credit on the card is $800 (80%).

Think of this as your buying power, this is the amount of credit at your disposal at any given time.

The key is to find a good balance of debt to limit to maximize your credit scores.

The Fair Isaac Company (FICO) generally recommends that consumers keep their credit utilization as low as possible but, above 0% to maximize their credit scores.

FICO High Achievers

Consumers with FICO scores of 780+

• Have an average revolving credit utilization ratio of 5.8%

• Have an average of 3 accounts carrying a balance

• Owe less than $3,000 on revolving accounts